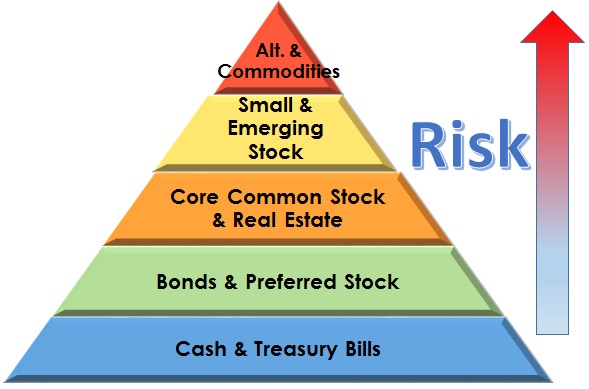

A thoughtful approach to investing includes an understanding of portfolio basics. Whether you are seeing an investment pyramid for the first time or revisiting fundamentals, it is important to recognize and understand the risks that you may be taking in your investment posture. Markets are not singularly directional. By considering overall portfolio construction, a sound basis for investing can be established. Often overlay strategies to these core positions are required to meet various investor objectives.

Each portfolio group contains four distinct portfolios designed with similar risk profiles, but approached in a way to give investors the flexibility to choose which style is right for them. The four types are defined as:

Clearview Core Mutual Fund – Our primary core portfolios constructed with active managers and use no load, no transaction fee funds for low cost access and no cost rebalancing.

Clearview Core Institutional Mutual Fund – Identical active managers as our Core mutual fund portfolios, but with lower internal expenses and a small transaction fee. Ideal for larger ($200k+) accounts with infrequent rebalancing needs.

Clearview ETF – For those interested in high quality, low cost access but wanting to eschew active management for a more passive index-oriented approach.

Clearview NF ETF – Our ultimate low cost, no transaction fee solution for a passive investment approach. Ideal for small sums and start-up accounts.

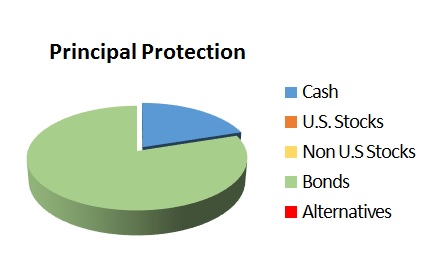

Clearview Principal Protection Portfolios are designed to be liquid and safe. They feature historically low volatility with returns commensurate with cash and short term investments.

Clearview Principal Protection Portfolios are designed to be liquid and safe. They feature historically low volatility with returns commensurate with cash and short term investments.

Clearview Principal Protection (example)

Clearview Principal Protection Instl.

Clearview ETF Principal Protection

Clearview NF ETF Principal Protection

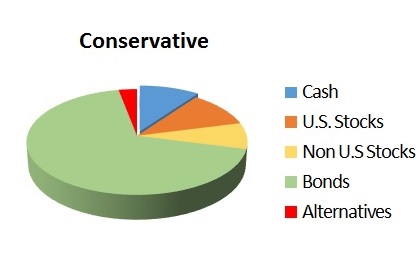

Clearview Conservative Portfolios have all the elements of a well diversified portfolio, but allocated in a way to keep risks low while increasing potential returns above cash and short term investment levels.

Clearview Conservative Portfolios have all the elements of a well diversified portfolio, but allocated in a way to keep risks low while increasing potential returns above cash and short term investment levels.

Clearview Conservative

Clearview Conservative Instl.

Clearview ETF Conservative

Clearview NF ETF Conservative

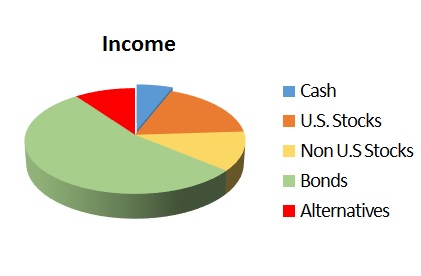

Clearview Income Portfolios are geared toward income generation with a component to deal with rising inflation over time.

Clearview Income

Clearview Income Instl. (example)

Clearview ETF Income

Clearview NF ETF Income

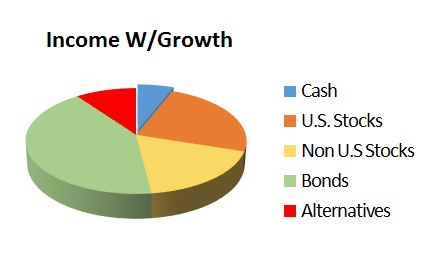

Clearview Income W/Growth Portfolios broaden out the discipline in the income portfolio to include a larger slice devoted to principal growth.

Clearview Income W/Growth Portfolios broaden out the discipline in the income portfolio to include a larger slice devoted to principal growth.

Clearview Income W/Growth

Clearview Income W/Growth Instl.

Clearview ETF Income W/Growth

Clearview NF ETF Income W/Growth

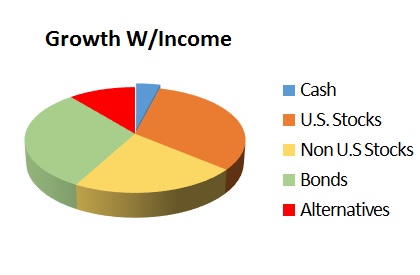

Clearview Growth W/Income Portfolios are intended to grow principal with an eye toward risk control and with a component of income.

Clearview Growth W/Income Portfolios are intended to grow principal with an eye toward risk control and with a component of income.

Clearview Growth W/Income

Clearview Growth W/Income Instl.

Clearview ETF Growth W/Income

Clearview NF ETF Growth W/Income

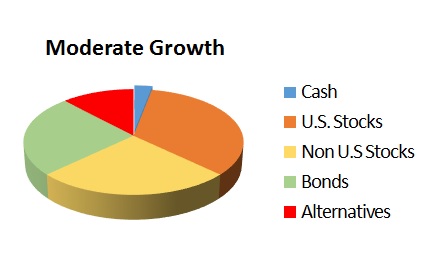

Clearview Moderate Growth Portfolios are designed for individuals who are accumulating assets, but who want to do it with an eye toward risk management.

Clearview Moderate Growth Portfolios are designed for individuals who are accumulating assets, but who want to do it with an eye toward risk management.

Clearview Moderate Growth

Clearview Moderate Growth Instl.

Clearview ETF Moderate Growth (example)

Clearview NF ETF Moderate Growth

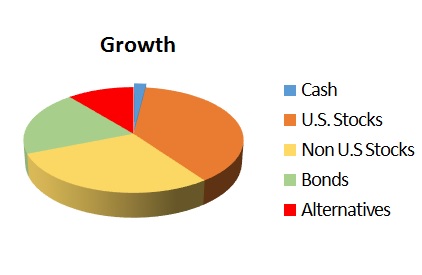

Clearview Growth Portfolios are well diversified strategies for accumulating wealth and are intended for investors with an ample appetite for risk and a long time horizon.

Clearview Growth Portfolios are well diversified strategies for accumulating wealth and are intended for investors with an ample appetite for risk and a long time horizon.

Clearview Growth

Clearview Growth Instl.

Clearview ETF Growth

Clearview NF ETF Growth

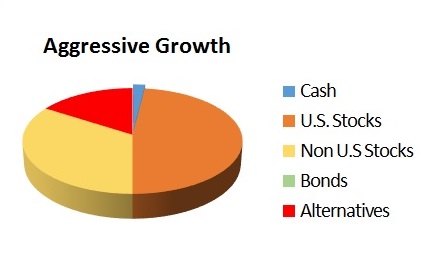

Clearview Aggressive Growth Portfolios are a diversified mix of growth assets geared toward the aggressive accumulation of wealth and intended for investors with a long time horizon and a high temperament for risk.

Clearview Aggressive Growth Portfolios are a diversified mix of growth assets geared toward the aggressive accumulation of wealth and intended for investors with a long time horizon and a high temperament for risk.

Clearview Aggressive Growth

Clearview Aggressive Growth Instl.

Clearview ETF Aggressive Growth

Clearview NF ETF Aggressive Growth (example)